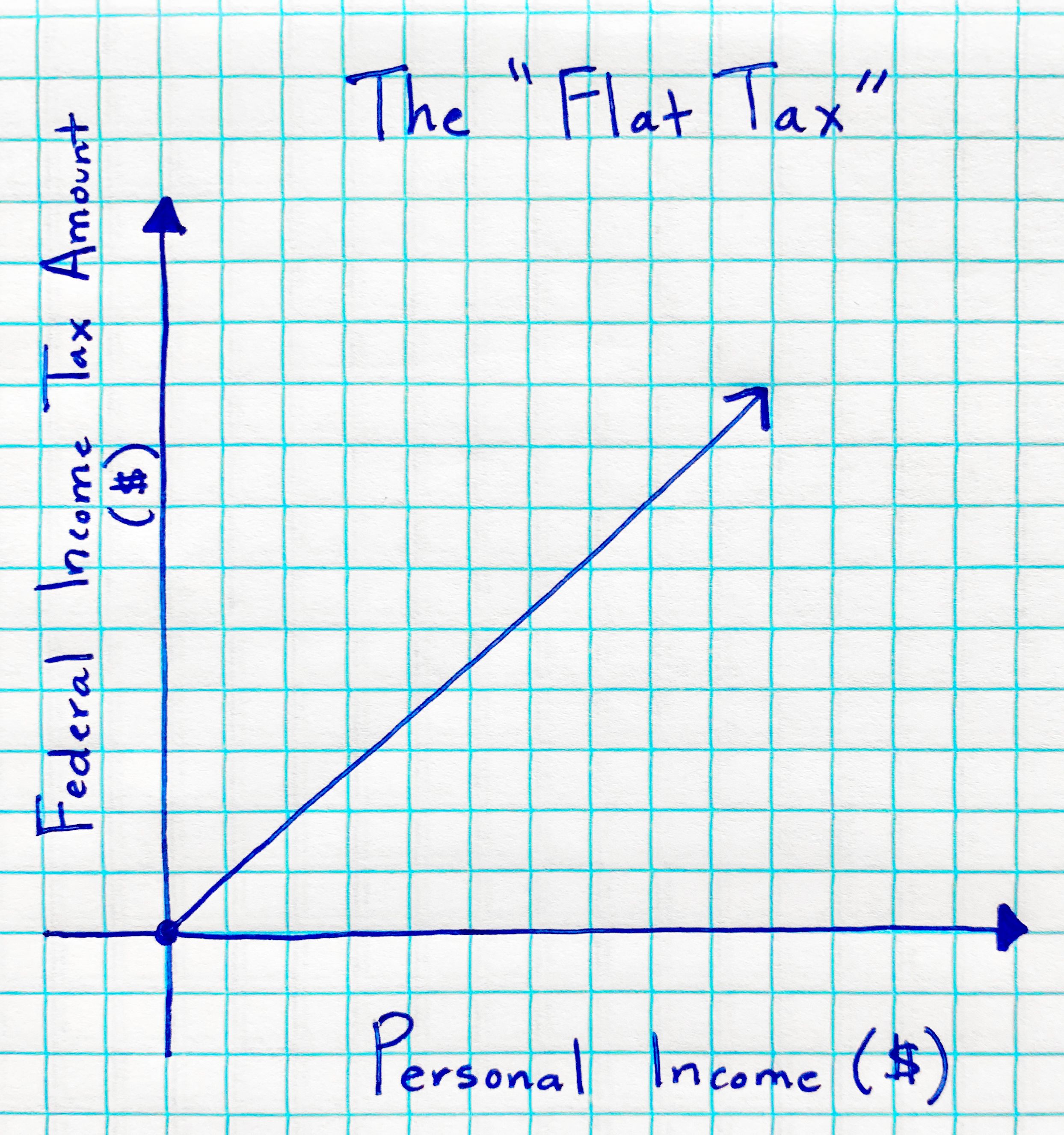

To voters, the process feels mysterious, in the same way, in fact, that the 2008 bailouts did: Some expert, somewhere, picks AIG over Lehman Brothers. Structuring a progressive tax schedule requires meticulous calibration by panels of experts. Jeb Bush, Marco Rubio and Donald Trump pay their respects with plans that reduce the number of tax brackets. Ben Carson, Mike Huckabee and Rand Paul also propose some kind of flat rate. Several of this campaign’s flat taxers are actually out-Forbesing Forbes.

The simple levy hasn’t been this popular since 1996, when Steve Forbes campaigned with the promise of a universal 17% income tax rate. Republicans by contrast are heading toward the very un-progressive flat tax. You can bet Bernie Sanders’s plan, when it comes, will redistribute even more dramatically. Clinton’s former fellow candidate Lincoln Chafee offered to raise the top marginal income tax rate to 45% from the current 39.6%. So Hillary Clinton proposes increases in capital-gains-tax rates for top earners.

Voters are still frustrated by the arbitrary quality of the rescues and the uneven quality of the recovery. That’s the Democratic tax philosophy seven autumns after the financial crisis.

0 kommentar(er)

0 kommentar(er)